It takes a whole startup ecosystem to create successful companies, and that includes both entrepreneurs and the Angel investors who make those startups grow.

The Fledge Angel Accelerator provides not only the necessary knowledge on how to invest in startups, but more importantly, hands-on-experience in making investments.

Language

The program begins with a weekly series of topics and discussions to learn a common language of early-stage investing.

Selection

As the participants learn how to invest, they use that knowledge to choose the incoming participants of the startup accelerator.

Guidance

The investors then guide those startups through two months of intense business planning and due diligence, learning how to lead follow-on investments.

In short, the investors learn how to invest by being investors, learning within a cohort of other new investors, and learning side-by-side with first-time entrepreneurs, who are eager for the guidance only investors can provide. This is all facilitated by experts in entrepreneurship and investing.

Topics

Participants will learn a wide variety of topics related to investing, including:

- How startup investing works

- The role of Angels in startups

- How Angel Groups work in practice

- What entrepreneurs want from investors (beyond money)

- Deconstructing a startup investor pitch

- The whole due diligence checklist

- Yellow flags and red flags in due diligence

- Investment terms and preferences

- Debt, equity, and revenue-based structures

- Legalities and securities laws

- Portfolio and fund management

- International investing

Time, Terms, and Conditions

The next Fledge Angel Accelerator begins with seven free weekly workshops Wednesday, January 13th through Wednesday, February 24th, 6pm PT / 9pm ET.

At the end of February we’ll ask for participation in the paid program, which runs weekly for 12 Wednesdays, March 13th through May 19th, also at 6pm PT / 9pm PT, 60-75 minutes per week.

Workshops

RSVP to the free webinars on Eventbirte.

Wednesdays, January 13th through February 24th, 6pm PT / 9pm ET.

Workshop Slides from 2020

Workshop #1

An Accelerator for Angels?

What is Fledge? What is an Accelerator? What is the timeline for this training program?

Workshop #2

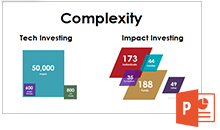

Philanthropy vs. Investing

Isn’t it up to philanthropists and governments to fix poverty, hunger, inequality, and the other big problems of the world? How can investors mix impact with investing?

Workshop #3

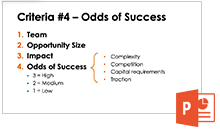

Sifting Success from Failure

How do you quantify the odds of success of a startup? How do turn gut feel into an actionable, measurable score?

Workshop #4

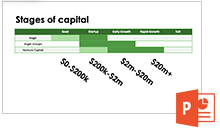

Startup Investing 101

Why do Angel investor? How do Angels find investable startups? How do Angel groups and VC funds work? Can Angels make money?

Workshop #5

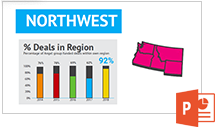

Global Investing

Why does 80%+ of Angel investing take place within the same city or region as the investor? What are the risks and advantages of global investing?

Workshop #6

Angels vs. Angel Groups vs. Funds vs. Accelerators + Foundations & Families

Startup investing as a lot of participants. Understanding the landscape is important.

Workshop #7

Investing without Exits

Venture capital has not been around forever, and the tools and structures they’ve created in the last 40-50 years are not useful for 99% of all startups.

Workshop #8

Yellow Flags

When reviewing “deal flow” what are the red and yellow flags to look out for, and how accelerators look to fix such flaws.

2021 Angel Accelerators

2021 USA (virtual)

This next Angel Accelerator for U.S.-based Angels launches January 13th, 2021.

2021 Africa (virtual)

This second Angel Accelerator will be pan-Africa, launching January 13th, 2021.

RSVP to the free webinars on Eventbirte.

Wednesdays, January 13th through February 24th, 6pm PT / 9pm ET.

Interested participants should subscribe to our newsletter and contact us.